In term of organizational structure level, stock transfer posting between plants can occur in a same company code or cross-company codes.

Stock Transfer Posting between plants in a same company code

- If the material transferred between plants is not-valuated material ("value update indicator" is not set in the material type configuration for the plants), the stock transfer posting does not affect accounting.

- If the material is valuated for the plants where stock transfer posting occurs and the valuation level is company code, stock transfer posting also does not affect accounting. It's because the value of a certain material in all plants in the company code is the same.

- If the material is valuated for the plants where stock transfer posting occurs and the valuation level is plant, stock transfer posting will affect accounting.If the procedure used is one-step transfer posting, the transaction will create accounting journals when it's posted. The inventory account in the issuing plant will be credited and the one in the receiving plant will be debited.If the procedure used is two-steps transfer posting, the "Remove from Storage" transaction will create accounting journal when it's posted. The inventory account in the issuing plant will be credited, and the one in the receiving plant will be debited (although in term of quantity it's still on "stock in transfer" in the receiving plant, not in "unrestricted-stock" yet).

The "Place in Storage" transaction will not create accounting journal as it only transfers "stock in transfer" to "unrestricted-stock" in the receiving plant (in a same plant).

Cross-Company Codes Stock Transfer Posting

Cross-Company Codes stock transfer posting is actually stock transfer posting between plants (from a plant to another plant), but both plants are under different company codes.

- If the material transferred between plants is not-valuated material ("value update indicator" is not set in the material type configuration for both plants), the stock transfer posting does not affect accounting.

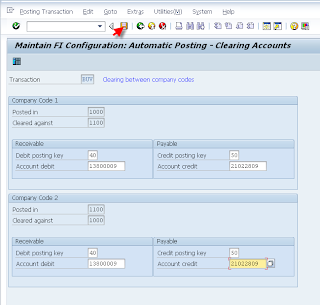

- If the material is valuated for the plants where stock transfer posting occurs, stock transfer posting will affect accounting, whether the valuation level is plant or company code (because, if the plants are under different company codes, it means that they must have different valuation areas).In order to make the stock transfer posting can be done cross-company codes, we have to maintain the clearing account for each company code. We can maintain it with OBYA tcode.

The above image is © SAP AG 2011. All rights reserved

The above image is © SAP AG 2011. All rights reservedIf the procedure used is one-step transfer posting, the transaction will create two accounting journals (two accounting documents) when it's posted:- In the issuing plant's company code: The inventory account is credited and the clearing account (an Account Receivable/AR account) is debited.

- In the receiving plant's company code: The inventory account is debited and the clearing account (an Account Payable/AP account) is credited.

If the procedure used is two-steps transfer posting: - The "Remove from Storage" transaction will create two accounting journals (two accounting documents) when it's posted:

- In the issuing plant's company code: The inventory account is credited and the clearing account (an Account Receivable/AR account) is debited.

- In the receiving plant's company code: The inventory account is debited and the clearing account (an Account Payable/AP account) is credited.

In term of quantity it's still on "stock in transfer" in the receiving plant, not in "unrestricted-stock" yet. - The "Place in Storage" transaction will not create accounting journal as it only transfers "stock in transfer" to "unrestricted-stock" in the receiving plant (in a same plant).

Reblogged from iERP.us

0 comments:

Publicar un comentario

Nota Importante: los comentarios son para agradecer, comentar o sugerir cambios (o hacer preguntas) sobre el artículo de arriba.

SAP y el logotipo de SAP son marcas comerciales registradas de SAP AG en Alemania y en varios otros países. No estamos afiliados ni relacionados con ninguna división o subsidiaria de SAP AG.